By Pieter Davis, head of business development, Edge Capital

Above-average returns in South Africa during the last decade as a result of favourable external factors such as strong commodity prices, appetite for higher risk premiums in emerging markets and a strong currency may not be repeatable in the future. The massive debt burden in developed countries combined with far more stringent regulations and reserve requirements for the financial system are likely to lead to more muted returns going forward. The wider opportunity set in Regulation 28 now allows trustees to seriously consider these changes in an environment of lower return expectations, of higher volatility, less evidence of clear market trends and the behavioural or psychological fortitude which will test the mettle of fund managers and trustees.

In such an environment, pro-actively seeking capital growth with more flexibility in investment strategies and techniques from as many differentiated sources of both beta (market) and alpha (manager skill) should be actively pursued in order to achieve acceptable returns but also provide less emotional anxiety through the expected volatility. Whilst the natural inclination of human nature is to resist change especially given the complexity of the subject choice, this increased opportunity set can greatly assist retirement members in achieving:

1 A more “efficient” rate of growth in capital over time

2 whilst enduring less anxiety by way of lower volatility in the short term to earn higher returns

3 AND thus assist them from falling prey to some of the basic behavioural or “cognitive” errors we are all

Hedge funds: Differentiated returns with lower volatility

Hedge funds are private investment vehicles structured to generally deliver absolute returns with low volatility, regardless of market conditions. They are managed by experienced, highly specialised investment professionals who typically trade only within their area of expertise and competitive advantage. Hedge fund returns are less correlated to the performance of broader financial markets. They achieve this by taking positions in mispriced instruments where the realisation of a perceived value “gap” is triggered by an event specific to the individual security rather than linked to the general direction of the markets. They also employ non-traditional hedging and risk management techniques of various levels of sophistication and complexity, including leverage, short sales and derivatives. For them to be effective in exploiting these opportunities and techniques, they limit the size of the money they manage. Having this flexibility to use diverse investment strategies allows hedge funds to exploit opportunities without the constraints normally placed on conventional asset management.

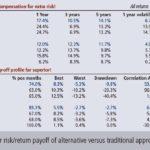

Figure 1 succinctly demonstrates the return and risk measures of the specialist equity and bond survey data from both the long-only or traditional world and the hedge fund equivalent world respectively. Whilst the hedge fund universe consists of a number of different strategies, it is the combination of these different strategies that can provide investors with significant diversification benefits and produce better risk-adjusted returns. Due to the highly specialised nature of the strategies employed, funds of hedge funds invest in a portfolio of different strategies to provide broad exposure to the hedge fund industry and diversify away the risks associated with a single investment fund or strategy. These funds of hedge funds select underlying managers and construct portfolios based upon clients’ specific risk and return requirements. While there generally is no “one size fits all” approach, most fund of fund managers use strategy-specific building blocks to create an overall bespoke client solution.

Figure 1 succinctly demonstrates the return and risk measures of the specialist equity and bond survey data from both the long-only or traditional world and the hedge fund equivalent world respectively. Whilst the hedge fund universe consists of a number of different strategies, it is the combination of these different strategies that can provide investors with significant diversification benefits and produce better risk-adjusted returns. Due to the highly specialised nature of the strategies employed, funds of hedge funds invest in a portfolio of different strategies to provide broad exposure to the hedge fund industry and diversify away the risks associated with a single investment fund or strategy. These funds of hedge funds select underlying managers and construct portfolios based upon clients’ specific risk and return requirements. While there generally is no “one size fits all” approach, most fund of fund managers use strategy-specific building blocks to create an overall bespoke client solution.

Different risks that need to be managed

Risk from a retirement fund perspective should be classified as not having accumulated a large enough capital base to sustain the member during the golden years, as investors are fully aware of the devastation that inflation plays on the value of money or their capital. History demonstrates that the lowest risk to a capital base, which is to prevent a permanent loss of money, is to place your money with the highest credit rated money market fund. But, the same history also demonstrates that this is the lowest after-tax return and certainly not in the interest of providing inflation-beating returns. The primal instincts of fear and greed, and hence inappropriate investor behaviour, further com- pound this perpetual conflict of not meeting the primary objective of capital growth because the short-term orientation and focus prevents appropriate risk-taking by rather investing in low-volatility assets with lower real returns.

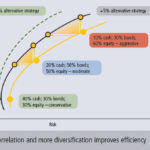

Figure 2 demonstrates the challenges of aiming to achieve as high as possible a return in a potentially low-growth environment but within reasonably acceptable risk parameters. It is therefore critical in a defined contribution environment with member choice and the ability to switch at any point in time, to be reminded of the multiple objectives a fund should try to achieve with the seemingly “simple” concept of risk. The member needs to achieve the highest possible return (real return risk) by assuming the most tolerable level of both interim risk (monthly or annual volatility or standard deviation) as well as absolute risk (the permanent loss of capital by locking in losses at the wrong time). This can be achieved more optimally by introducing some of the newly allowed asset classes or components to their existing strategies because, the basic premise of any well diversified portfolio is one where the return, and consequently the risk, arises from as many unrelated (or independent) sources as possible. This concept is commonly demonstrated by the efficient frontier (see figure 3). The basic idea is to build the most “efficient” portfolio using a complementary mix of the investable asset classes at our disposal through statistically matching their long-term return and volatility characteristics. In essence, a portfolio in the top left corner of this return versus risk equation is more optimal and desirable than one in the bottom right corner.

Figure 2 demonstrates the challenges of aiming to achieve as high as possible a return in a potentially low-growth environment but within reasonably acceptable risk parameters. It is therefore critical in a defined contribution environment with member choice and the ability to switch at any point in time, to be reminded of the multiple objectives a fund should try to achieve with the seemingly “simple” concept of risk. The member needs to achieve the highest possible return (real return risk) by assuming the most tolerable level of both interim risk (monthly or annual volatility or standard deviation) as well as absolute risk (the permanent loss of capital by locking in losses at the wrong time). This can be achieved more optimally by introducing some of the newly allowed asset classes or components to their existing strategies because, the basic premise of any well diversified portfolio is one where the return, and consequently the risk, arises from as many unrelated (or independent) sources as possible. This concept is commonly demonstrated by the efficient frontier (see figure 3). The basic idea is to build the most “efficient” portfolio using a complementary mix of the investable asset classes at our disposal through statistically matching their long-term return and volatility characteristics. In essence, a portfolio in the top left corner of this return versus risk equation is more optimal and desirable than one in the bottom right corner.

Figure 3 demonstrates this concept graphically, and how the addition of South African multi-strategy hedge funds do indeed have the desired effect of moving funds to the top left of the graph. A more simplistic way of demonstrating this effect is shown in figure 4. This shows a simple scatter plot of the annualised return and volatility (standard deviation) of various market benchmarks as well as some traditional balanced funds and pure equity survey returns. As a hedge fund proxy, the graph includes the Edge Iconic Fixed Interest and the Edge Iconic Matador II multi-strategy fund of funds. The graph demonstrates the potential for these hedge funds to add good returns but at much lower volatility during what was a particularly testing time for financial markets.

Figure 3 demonstrates this concept graphically, and how the addition of South African multi-strategy hedge funds do indeed have the desired effect of moving funds to the top left of the graph. A more simplistic way of demonstrating this effect is shown in figure 4. This shows a simple scatter plot of the annualised return and volatility (standard deviation) of various market benchmarks as well as some traditional balanced funds and pure equity survey returns. As a hedge fund proxy, the graph includes the Edge Iconic Fixed Interest and the Edge Iconic Matador II multi-strategy fund of funds. The graph demonstrates the potential for these hedge funds to add good returns but at much lower volatility during what was a particularly testing time for financial markets.

Investors are constantly searching for less volatile returns with limited downside (negative returns) to compensate for volatile, higher returns but with the risk of some big losses (negative returns). The general theory is that if an investor has enough time on their side, they can stomach this rollercoaster as these big negatives have to be endured to earn decent long-term returns.

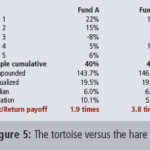

Figure 5 succinctly demonstrate the trickery that erratic returns can play on even the most astute investor. An investor can arrive at a seemingly identical end point, but with a very different emotional experience. Most investors would concur that the less volatile road should be the more preferable one. Whilst the allure of initial high returns can suck less experienced investors into  Fund A, a sudden and dramatic drop in the middle of the journey will invariably demonstrate the higher risk element of the strategy and the emotional turmoil is then likely to force a similar “greed versus fear” response from investors. The investment community has tried to deal with this conundrum through the introduction of so-called long-only Absolute Return products. Whilst the approach has proven very popular at times of market turmoil, through the economic cycle most have shown themselves to be either pure fixed interest or slightly lower risk balanced funds in disguise. Hedge funds do offer another alternative.

Fund A, a sudden and dramatic drop in the middle of the journey will invariably demonstrate the higher risk element of the strategy and the emotional turmoil is then likely to force a similar “greed versus fear” response from investors. The investment community has tried to deal with this conundrum through the introduction of so-called long-only Absolute Return products. Whilst the approach has proven very popular at times of market turmoil, through the economic cycle most have shown themselves to be either pure fixed interest or slightly lower risk balanced funds in disguise. Hedge funds do offer another alternative.

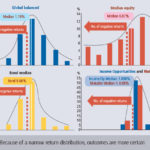

Another way to demonstrate the benefit of adding more stable returns with fewer downside surprises is through plotting the number of times a  fund’s return has been in a certain range, and then showing these frequencies in the form of a histogram (see figure 6).

fund’s return has been in a certain range, and then showing these frequencies in the form of a histogram (see figure 6).

This “pay-off” profile visually shows the “normal” distribution of returns, and for those investors that are statistically minded the concept of the bell curve will immediately become evident. The two Edge Iconic fund of funds were again used to demonstrate the very narrow or more consistent return profile of hedge funds, whereas both the median equity survey and global balanced survey returns show very wide ranges of return. More importantly, they show a high frequency of very negative monthly returns with the Global Balanced median having achieved a greater than -6% return twice in the past five years, both -4% to -6% and -2% to -4% on three occasions each and less than 0% to -2% on as many as 12 occasions. This is a total of 20 out of 60 observations or one-third of the time. Whilst the median monthly return of 1.19% over the five-year period is reasonably good, the two Edge fund of funds would have given slightly lower returns BUT with a maximum downside return of -2% on no more than eight occasions for the higher risk Matador II fund over this entire period. It should be very evident from the above statistics that trustees choose to ignore the “smoothing” merits, low correlation and more limiteddown-side of hedge funds at their own peril.